Technical Report Underscores Large, Multi-generational

High-Grade Colemanite Deposit to Support Domestic Supply of

Boron Amid Growing Demand

HESPERIA, CALIFORNIA / ACCESS Newswire / August 7, 2025 / 5E Advanced Materials, Inc. (“5E” or the “Company”) (Nasdaq:FEAM)(ASX:5EA), a boron and lithium company designated as Critical Infrastructure by the U.S. Department of Homeland Security, is developing one of the world’s largest new conventional boron deposits through a vertically integrated platform, is pleased to announce the completion of the Preliminary Feasibility Study (the “Technical Report”) for the Company’s Fort Cady Project (the “Project”) located in the Mojave Desert, near the town of Newberry Springs, California.

The Project underpins 5E’s strategy to become a vertically integrated global supplier of critical and industrial materials through in-situ extraction of colemanite, from which the Company intends to produce boron and calcium-based products which will support global electrification, energy, food security, and critical defense applications.

Highlights of the Pre-Feasibility Study

-

Technical Report is specifically focused on Phase 1 of the Project, converting 41% of the resource into 5.4M tons of boric acid (H3BO3) reserves yielding 39.5-year life of mine

-

Total Mineral Reserves of 5.4M tons boric acid with grade of 8.03% (B2O3)

-

Technical Report ONLY includes Phase 1 production and presents robust economics with forecasted pre-tax net present value (NPV7) of US$724.8 million and 19.2% unlevered IRR

-

Project retains optionality for future expansion phases of additional production tonnage and value-added boron derivatives

-

The initial Phase 1 plant targets delivery of 130,000 tons per year of boric acid production, approximately ~11% of global boric acid demand today

-

Mining permits in place with the colemanite reserve mined using an in-situ leaching (“ISL”) method, thereby minimizing the surface land disturbance required for the Project facilities

-

The expected initial project capital cost (inclusive of a gas COGEN facility) is US$367M for Phase 1 plus US$55M contingency (15%) and US$13M of owner’s cost

-

By-product mix includes calcium chloride and gypsum with expected all-in sustaining cash (including logistics) of US$554.80 per ton of boric acid

-

Market study indicates tight supply with demand forecasted to exceed supply in 2026 driving boric acid prices higher

-

Revenue from production will primarily be derived from boric acid sales, approximately 94% of total revenue, while by-products of calcium chloride and gypsum will provide approximately 6% of total revenue

The Technical Report, which outlines an initial mine life of 39.5 years, confirms the strong economics of an ISL operation that would initially produce 130,000 short tons per year of boric acid along with calcium-based by-products; calcium chloride and gypsum. This Technical Report only includes Phase 1 of the Project, with optionality for phased expansion of additional tonnage and value-added boron derivatives.

The Company commenced mining operations in January 2024 and currently has a small-scale facility (“SSF”) that began operation in April 2024, which has provided invaluable operational data that has been incorporated into the basis of design for the Project. The SSF has achieved a steady state of production for boric acid and gypsum in addition to qualifying 14 customers who have set the stage for continued offtake negotiations. Most recently, two injection-recovery wells were converted to horizontal wells intercepting approximately 3,000 feet of high-grade colemanite.

“This technical report validates the economic strength and strategic importance of the Fort Cady Project,” stated Mr. Paul Weibel, Chief Executive Officer of 5E Advanced Materials. “With strong projected economics underpinned by meticulous technical work, we are now positioned to move into definitive feasibility planning, FEED-engineering and long-term project financing with the right team who have been critical in reaching this point in the development cycle. I am very pleased with 5E’s team and partners work to deliver this report. We have mined and processed for the last 18-months and have qualified product with over 14 large global end users. As we target large-scale commercial production in 2028, we look toward the economic potential of the Project, which we expect will provide high paying jobs in California and be a significant long-term U.S. producer of boron to maintain the security of the boron supply chain in the United States.”

5E will host a conference call to discuss the results of the Technical Report on Tuesday, August 12, 2025, at 5:00 p.m. EDT (2:00 p.m. PDT). The call will be hosted by 6ix with remarks from Mr. Paul Weibel, Chief Executive Officer of 5E Advanced Materials, Inc.

To participate, note the following:

DATE: August 12, 2025

TIME: 5:00 p.m. EDT (7:00 a.m. AEST on August 13, 2025)

LINK:Registration (https://6ix.com/event/5e-advanced-materials-market-update-1)

Details of the Pre-Feasibility Technical Report

The Technical Report summary results are presented in Table 1.

Table 1. Project Summary

|

Description |

Units |

Total/Amount |

|

Mine Life |

Years |

39.5 |

|

Reserves B2O3 (tonnage) |

Tons (short) |

3,003,955 |

|

Reserves H3BO3 (tonnage) |

Tons (short) |

5,335,023 |

|

Reserves B2O3 (grade) |

% |

8.03% |

|

Recovery B2O3 (in-situ) |

% |

81.9% |

|

Mining Efficiency (drilling) |

% |

95.0% |

|

Recovery B2O3 (processing) |

% |

95.1% |

Table 1. Project Summary (Continued)

|

Production |

||

|

Annual Production (H3BO3) |

Tons (short) per year |

130,000 |

|

Annual Production (Gypsum) |

Tons (short) per year |

129,000 |

|

Annual Production (CaCl2 ~ 38%) |

Tons (short) per year |

57,000 |

|

Capital Costs |

||

|

Initial Capital with Contingency |

$M USD |

435.0 |

|

Sustaining Capital |

$M USD |

39.9 |

|

Total Capital (life of mine) |

$M USD |

474.8 |

|

Operating Costs (Full-Run Rate) |

||

|

Variable Costs |

$/t H3BO3 |

405.7 |

|

Fixed Costs |

$/t H3BO3 |

222.1 |

|

Credits |

$/t H3BO3 |

(73.0) |

|

Net Total Costs (inclusive of logistics) |

$/t H3BO3 (net) |

554.8 |

|

Economic Analysis |

||

|

Average Price LOM – H3BO3 |

$/short ton |

1,355 |

|

Netback Price – Gypsum |

$/short ton |

21 |

|

Netback Price – CaCl2 ~38% |

$/short ton |

120 |

|

Pre-Tax: Free Cashflow |

$M USD |

3,749 |

|

Pre-Tax: NPV7 |

$M USD |

725 |

|

Pre-Tax: IRR |

% |

19.2 |

|

After-Tax: Free Cashflow |

$M USD |

2,625 |

|

After-Tax: NPV7 |

$M USD |

469 |

|

After-Tax: IRR |

% |

15.9 |

|

After-Tax: Payback Period |

Years |

5.9 |

Project Location

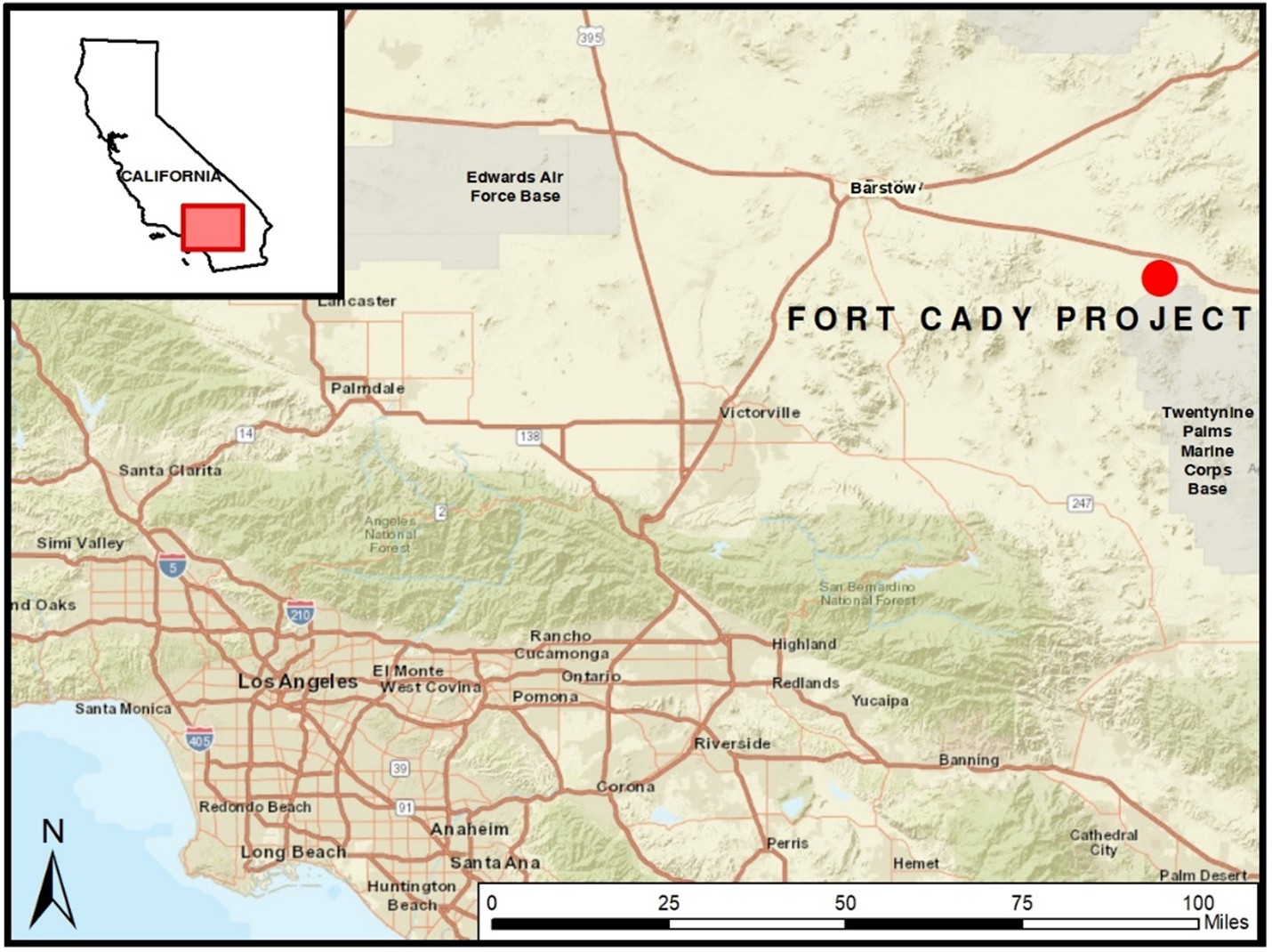

The Project is located halfway between Las Vegas, Nevada and Los Angeles, California and includes both private and federal land. The Project is located approximately 2 miles south of Interstate 40 and approximately 25 miles east of Barstow, California. The site is connected to approximately 1 megawatt of grid power and is approximately 2 miles from major natural gas transmission lines and the BNSF rail line. Figure 1 shows the project location.

Figure 1. Fort Cady Project Location

Mineral Resources

The Technical Report defines both Mineral Resources and Mineral Reserves for the Project. The Mineral Resources on lands under 5E’s mineral control include 23.5 million short tons of Measured ore containing 3.26 million short tons of in-situ boric acid, with an average grade of 7.91% B₂O₃. The Indicated category comprises 85.6 million short tons of ore containing 11.8 million short tons of in-situ boric acid, with an average grade of 7.89% B₂O₃. Mineral resources were estimated using a 2.0% B2O3 cut-off grade and Table 2 summarizes the mineral resources.

Table 2. Fort Cady Project Mineral Resources

|

*Mineral Resources |

||||

|

Short Tons (MST) |

B2O3 (wt. %) |

B2O3 (MST) |

H3BO3 (MST) |

|

|

Measured |

23.50 |

7.91 |

1.84 |

3.26 |

|

Indicated |

85.63 |

7.89 |

6.66 |

11.83 |

|

Total Measured + Indicated |

109.13 |

7.89 |

8.50 |

15.09 |

|

Total Inferred |

4.26 |

7.45 |

0.31 |

0.55 |

*Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Under S-K 1300, inferred mineral resources are not considered economically recoverable within the current mine plan and are excluded from the production schedule and economic analysis. Inferred Mineral Resources include areas not currently under mineral tenure control. These are disclosed for transparency but excluded from the mine plan and economic model. The Company makes no assurance that mineral rights to these areas will be secured.

Notes to Mineral Resources:

-

The Mineral Resources in this estimate were independently prepared, including estimation and classification, by Steven Kerr, P.G., C.P.G, Escalante Geological Services, LLC, and are reported in accordance with the definition for Mineral Resources in S-K 1300.

-

The Mineral Resources were completed using a gridded seam model with Carlson Mining™ software.

-

The Mineral Resources are current as of March 10, 2025.

-

Mineral Resources are constrained assuming in-situ leaching and are reported at a cutoff grade of 2.0% B2O3, assume mineralized horizons exhibit lateral continuity that supports in-situ leaching mining methods and based on exploration data, there is reasonable continuity of colemanite mineralization throughout the deposit, respectively.

-

Only resources located on lands under current mineral control are reflected in the mine plan and economic analysis.

Mineral Reserves

A detailed mine production plan was developed to support the calculation of Mineral Reserves. The mine plan and wellfield optimization are based on third-party engineering work that incorporated 19 months of actual wellfield performance data from the SSF into the design.

Mineral Reserve assumptions, such as plant efficiency, leaching efficiency, and mining efficiency were taken into consideration to calculate the reserve estimate. The operating costs were derived from material and energy balances as well as a detailed labor build developed from first principles. The following steps and assumptions were used to calculate Mineral Reserves:

-

Measured and Indicated Mineral Resource of fee-based land and the power corridor were used as the base resource and Inferred Resources were excluded.

-

The mine plan includes a Phase 1 plan for which 5E has demonstrated mineral tenure.

-

Trade off analysis of actual vertical well performance relative to expected horizontal well performance can increase colemanite contact up to 20x with extended lateral wells and achieve permeable driven injection rates of +100 gallons per minute.

-

The surface chemical plant would deliver a 95.1% boric acid yield.

-

Leaching efficiency is 81.9% based on leach testing.

-

Solution mining efficiency is 95.0% based on the July 2025 horizontal well drill program.

-

Discounted cash flow incorporated capital and operating cost inputs.

Mineral Reserves are reported in-situ using a 2.0% B2O3 cut-off grade. Table 3 summarizes the Mineral Reserves for the Project.

Table 3. Fort Cady Project Mineral Reserves

|

Mineral Reserves |

|||||

|

Average B2O3 Grade (wt. %) |

Recoverable Mineralized Bed Volume (ft3) |

B2O3 (MST) |

H3BO3 (MST) |

||

|

Proven |

8.03 |

19,894,414 |

0.76 |

1.35 |

|

|

Probable |

8.03 |

58,565,846 |

2.24 |

3.98 |

|

|

Total Reserves |

8.03 |

78,460,260 |

3.00 |

5.33 |

|

Notes to Mineral Reserves:

-

The Mineral Reserves in this estimate were independently prepared, including estimation and classification, by Alan White, P.E., Miocene, Inc., and are reported in accordance with the definition for Mineral Reserves in S-K 1300.

-

The Mineral Reserve Estimate is based on a cut-off grade of 2.0% B₂O₃. Mining recovery, mining efficiency, and process recovery factors applied were 81.9%, 95.0% and 95.1%, respectively, based on pilot-scale testing and engineering assumptions outlined in the Pre-Feasibility Study.

-

Mineral Reserves are a subset of the Measured and Indicated Mineral Resources and do not include Inferred Mineral Resources nor any Mineral Resource for which 5E does not have mineral tenure.

-

The Mineral Reserves are current as of August 4, 2025.

-

Rounding, as required by the guidelines, may result in minor summation differences between tons, grade, and contained B2O3 or H3BO3 content.

Mining Method

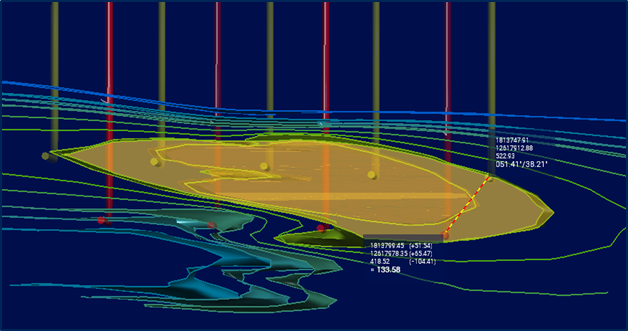

The Project will be employing in-situ leaching as its mining method to recover borates from the mineralized horizons. The depth and grade of the deposit precludes conventional mining techniques such as open pit and underground mining. With ISL mining, there is no stripping of waste rock or underground development required for the Project. ISL activities include drilling and constructing of injection/recovery wells, installing pumping or airlifting extraction equipment on the wells, and piping to transport barren leach solutions to the wellfield and Pregnant Leach Solution (“PLS”) back to the chemical plant for processing.

Based on the results of operating the SSF injection, recovery wells and work completed by 5E, the Large-scale Boron Facility (“LSBF”) calls for the installation of 27 directional wells targeting the upper mineralized horizon (“UMH”), major mineralized horizon (“MMH”), and lower mineralized horizon (“LMH”) spaced at 200-ft horizontal offset and 120 – 180-ft vertical spacing. The operating strategy of the wells will focus on high-grade mineralization zone cavern development through continuous injection and cyclic push-pull mechanics.

These wells are to operate as injection and recovery wells whereby injection and recovery of lixiviant through separate horizontal wellbores and full reservoir contact is accomplished by geo-steered laterals in a “fishbone” pattern and positively intercepting each well. The leach solution (lixiviant) is pumped into the well and, after a prescribed residence time, is retrieved from the same well, or offset wells as caverns develop, for processing. This method will be used until the dissolution of the colemanite in the deposit progresses to where complete reservoir flow is established between regional groups of wells. Figure 2 details the horizontal well schematic across the deposit.

Figure 2. Fort Cady Wellfield

Processing and Recovery Methods

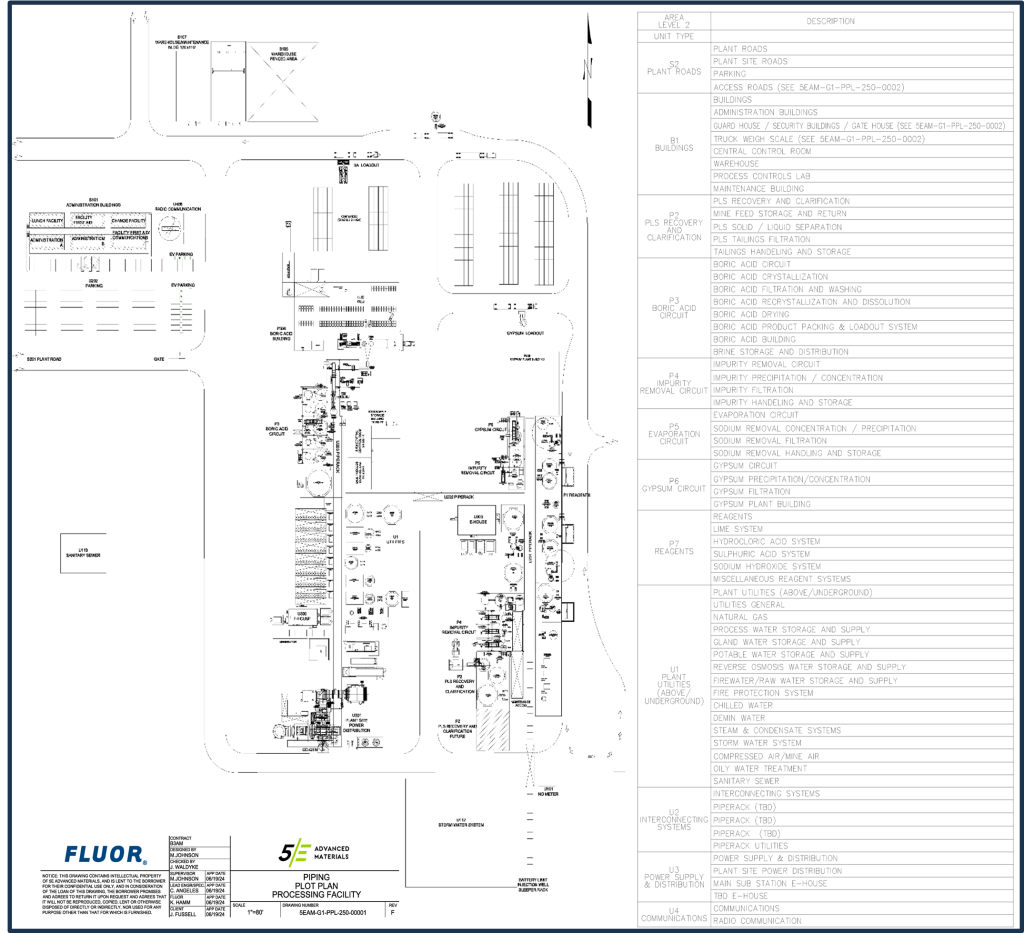

The processing facility at the LSBF is engineered to support high-efficiency, high-throughput extraction and refinement of boric acid and associated byproducts from the PLS. 5E successfully executed an extensive program of mineral processing and metallurgical testing. Based on these results, the company has selected a proven, crystallization-based process for boric acid extraction. This method has been validated through both laboratory-scale experiments and the operational success of the SSF. The following is a description of the process steps:

-

Solution Mining and Injection: Target minerals are dissolved in-situ using solution mining techniques utilizing heat and steam. The resulting PLS is transported via pipeline infrastructure to the surface processing facilities.

-

PLS Recovery and Clarification: The PLS undergoes pH adjustment through lime addition, which reduces acidity and enables the use of more cost-effective materials of construction. A multi-stage solid-liquid separation process, including filtration, removes precipitated solids, yielding a clarified solution ready for downstream processing.

Figure 3 Planned Site Layout

-

Boric Acid Circuit: This core section of the process is dedicated to the concentration, extraction, and purification of boric acid. A two-stage vacuum chilled crystallization system initiates the precipitation of boric acid, followed by filtration, washing, and redissolution. A second two-stage recrystallization step ensures high-purity product formation. Final dewatering is achieved via centrifugation, and the wet crystals are dried in a rotary dryer, cooled, and packaged. A portion of the centrate is directed to the Impurity Removal Circuit and the remainder is sent to the Gypsum circuit.

-

Impurity Removal Circuit and Evaporation: In the Impurity Removal stage, magnesium hydroxide [Mg(OH)₂] and other impurities are removed from the process stream through a reaction with hydrated lime. This reaction causes the impurities to precipitate, allowing them to be separated via filtration. The filtrate slurry then enters the evaporation circuit, where mechanical evaporators and evaporation ponds precipitate sodium chloride for removal. The concentrated brine, now enriched with calcium chloride (CaCl2), is either directed to truck loading for sale as a byproduct or sent to the Gypsum Circuit for further processing.

-

Gypsum Circuit: The Calcium Chloride rich brine reacts with sulfuric acid to precipitate gypsum, which is then filtered and refined to be sold as a byproduct. This circuit also facilitates the regeneration of hydrochloric acid, which is recycled back to the wellfield for reuse in the mining process.

Infrastructure

The Project is located near Interstate 40 along with nearby access to rail and a natural gas transmission line. Currently, the Project receives approximately 1 megawatt of shore power.

Infrastructure required for the Project is expected to consist of:

-

Natural gas – the Project will require a natural gas pipeline that will need to be connected into a nearby transmission pipeline to serve the processing plant. Discussions are ongoing with a proposal received from the owner of the pipeline and the cost of piping from the Mojave Pipeline to a cogeneration facility (COGEN) included in the capital estimate.

-

Electrical power upgrade – an economic trade-off study is currently being conducted to evaluate co-generation versus an upgraded and dedicated powerline to the Project. The economic analysis in the Technical Report assumes the Project utility is COGEN.

-

Rail – a connection to a rail spur adjacent to the Project is included in the federal permit. Phase 1 logistics contemplate trucking finished product to the customers in the western United States and the Los Angeles ports. Byproducts are expected to be sold in the local California market. Tie-in to rail is expected to be considered for expansion phases of the Project.

-

Roads – Plant access roads will require upgrades, and some roads may require paving. New access roads are also being considered.

-

Water – 5E currently has adequate water resources for Phase 1 of the project with two existing water wells with millsite claims for each well.

-

Material storage – storage for materials products and consumables will need to be built with storage for boric acid and gypsum included in the capital estimate. A calcium chloride load-out station is also included in the capital estimate and is expected to be stored in tanker trucks ready for distribution.

Environmental

In 1990, a Plan of Operations was submitted to the United States Bureau of Land Management (“BLM”) and a Mining Conditional Use Permit and Reclamation Plan was submitted to San Bernardino County, which triggered environmental review under the National Environmental Policy Act (“NEPA”) and the California Environmental Quality Act (“CEQA”). The BLM and San Bernardino County prepared a joint Environmental Impact Statement (“EIS”) and Environmental Impact Report (“EIR”) to satisfy their environmental review requirements under NEPA and CEQA. In 1994, the EIS and EIR process resulted in the issuance of a Record of Decision from the BLM that approved the Plan of Operations and approval of the Mining Condition Use Permit and Reclamation Plan from San Bernardino County. The Project is permitted to produce 90,000 short tons per year of borates, defined as boron oxide or boron oxide equivalent, thus permitting up to approximately 160,000 short tons of boric acid.

In 2020, a Class 3 Underground Injection Control (“UIC”) permit was issued by the United States Environmental Protection Agency (“EPA”). The EPA retains primacy for Class 3 solution mining UIC permits. In November 2023, the EPA approved the commencement of mining operations under this permit. These regulatory approvals form the foundation for Phase 1 development, which aligns with the previously authorized project scope.

Capital Costs

The Technical Report Summary for the Project has been successfully completed by Engineering, Procurement, and Construction Management company Fluor Corporation, Petroleum Engineering and Operating Services company Miocene, Inc., along with collaboration with Ad Infinitum, an engineering firm specializing in chemical process design. An AACE Class 4 estimate capital cost estimate (± 25%) has been prepared. The AACE Class 4 capital estimate covers the period from Front End Engineering Design engineering to first production and is reported in real dollars.

Capital cost expectations for a 130,000 short ton per annum boric acid plant (inclusive of co-product processing and COGEN power) were determined to be $367M for the first stage plus a contingency of $55M and owner’s cost estimate of $13M for a total capital estimate of $435M. Table 4 outlines the capital cost estimate, including initial development costs and a conservative provision for sustaining capital, based on solution mining-specific assumptions, including periodic wellfield expansion, re-drilling, and maintenance costs over the life of mine.

Table 4. Capital Cost Estimate

|

Scope |

Capital Cost (USD Millions) |

|

Process Facility |

$280.7 |

|

COGEN |

$50.2 |

|

Wellfield |

$30.8 |

|

Evaporation Ponds |

$5.6 |

|

Sub-total |

$367.3 |

|

Contingency |

$55.1 |

|

Owner’s Cost |

$12.5 |

|

Total Capital |

$434.9 |

Operating Costs

Operating costs for the project are segregated into Variable, Fixed, and Other operating costs and are based on detailed material and energy balances provided by Fluor Corporation and a principles first labor build-up. Variable operating costs include packaging, logistics, and raw materials such as natural gas, hydrochloric acid, sulfuric acid, and lime. Fixed operating costs include administrative labor, operating labor, general and administrative overhead, repair labor, repair materials, as well as taxes and insurance. Other operating costs include disposal costs of metals impurities offset with byproduct credits from gypsum and calcium chloride. Table 5 summarizes the operating cost by production phase.

Table 5. Operating Cost

|

Operating Costs (Full-Run Rate) |

||

|

Variable Costs |

$/t H3BO3 |

405.7 |

|

Fixed Costs |

$/t H3BO3 |

222.1 |

|

Credits |

$/t H3BO3 |

(73.0) |

|

Total Costs (inclusive of logistics) |

$/t H3BO3 (net) |

554.8 |

Figure 4. Operating Cost Breakdown

Economic Analysis

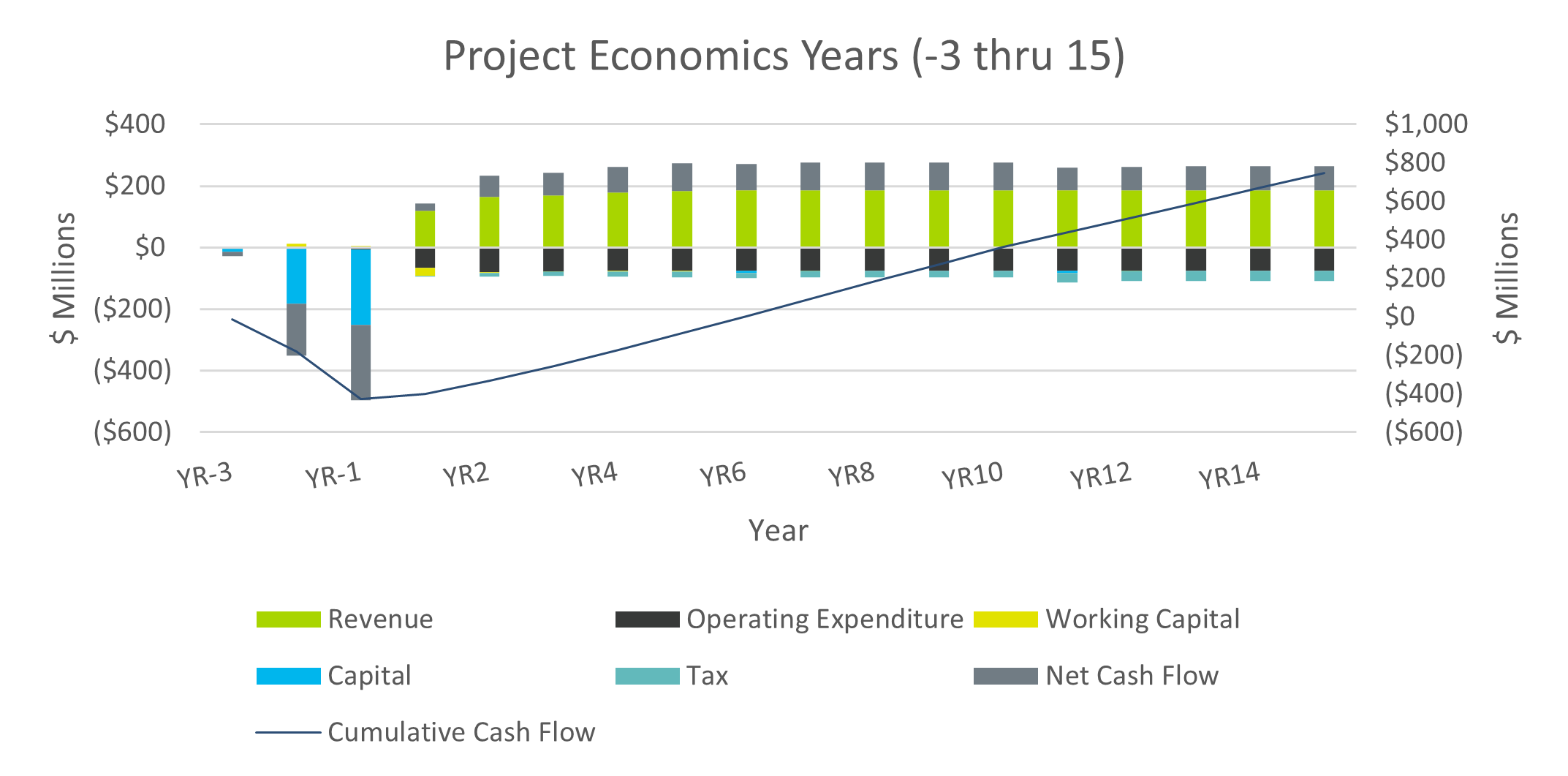

The Project economics were evaluated using a discounted cashflow analysis based on annual cashflows for the life of the project. The financial model was prepared on an annual basis from the mineral reserve effective date to the exhaustion of mineral reserves for the current mining plan. Mine life can be extended and the Project has additional resources that can be converted to additional mineral reserves with expansion of the wellfield or mine plan in the future. The financial model results are presented in real U.S. dollars.

As with the capital and operating forecasts, the economic analysis is inherently a forward-looking exercise. These estimates rely upon a range of assumptions and forecasts that are subject to change depending upon macroeconomic conditions, operating strategy and new data collected through operation of the SSF. Table 6 summarizes the economic results and Figure 5 highlights project cashflows during the first 15 years.

Table 6. Economic Analysis Summary

|

Description |

Units |

Total/Amount |

|

Average Price LOM – H3BO3 |

$ / short ton |

1,355 |

|

Netback Price – Gypsum |

$ / short ton |

21 |

|

Netback Price – CaCl2 |

$ / short ton |

120 |

|

Pre-Tax: Free Cashflow |

$M USD |

3,749 |

|

Pre-Tax: NPV7 |

$M USD |

725 |

|

Pre-Tax: IRR |

% |

19.2 |

|

After-Tax: Free Cashflow |

$M USD |

2,625 |

|

After-Tax: NPV7 |

$M USD |

469 |

|

After-Tax: IRR |

% |

15.9 |

|

After-Tax: Payback Period |

years |

5.9 |

Figure 5. Cashflow Profile by Year

Financial Model Sensitivity

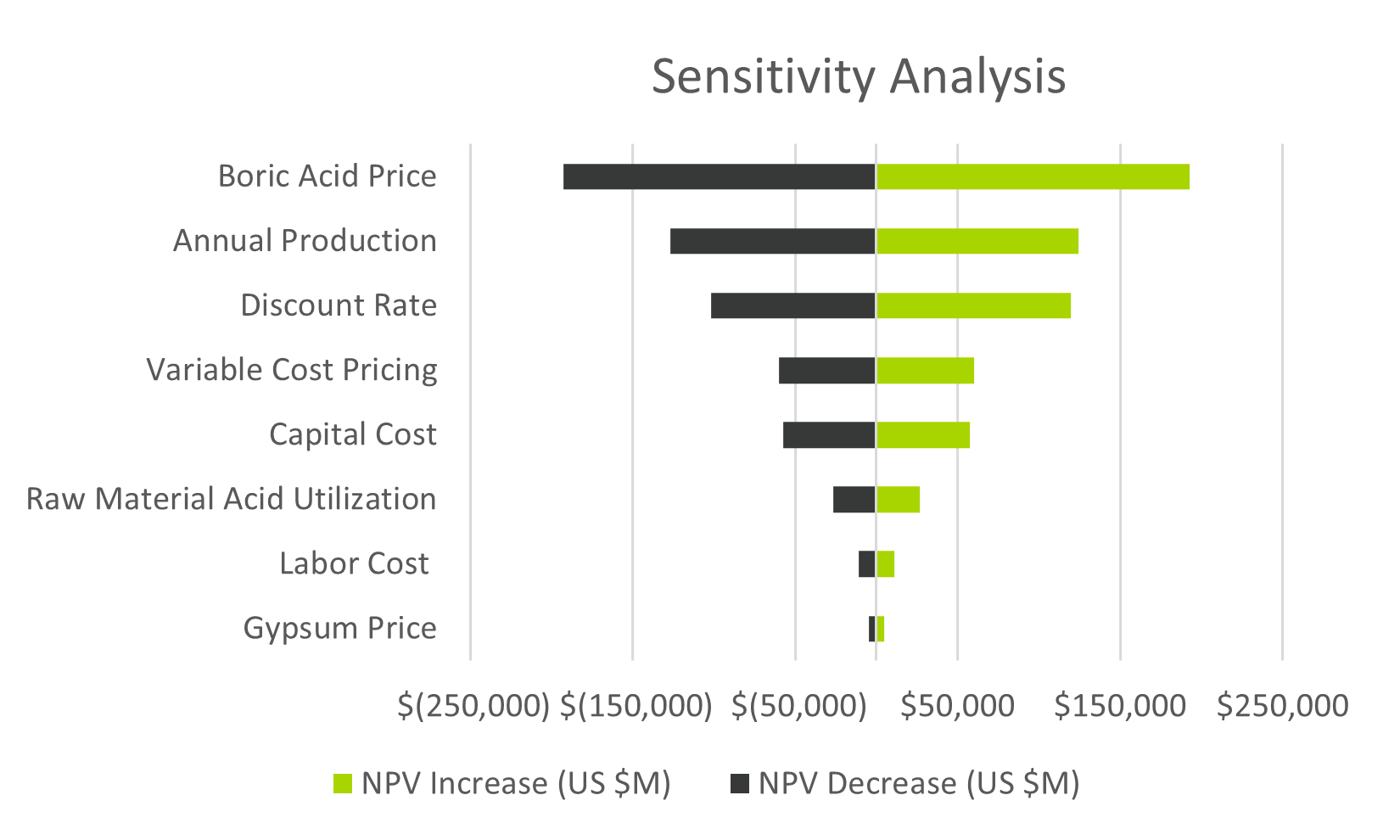

Sensitivity analysis for the financial model was performed based on changes to boric acid price, annual production, discount rate, variable cost pricing, gypsum price, labor cost per person, and raw material acid utilization. Using a ±10% change for each variable, NPV7 is plotted in real dollars for comparison and arranged in order of total variability.

Figure 6. Economic Sensitivity

Qualified Persons

The Technical Report, entitled “Preliminary Feasibility Report & Technical Report Summary, 5E Advanced Materials Fort Cady Project,” dated August 7, 2025, was prepared in accordance with the Securities and Exchange Commission S-K regulations, Title 17, Part 229, Items 601 and 1300 through 1305. The Technical Report was prepared by the following firms and persons: Miocene, Inc., Fluor Corporation, Geomega, Inc., Escalante Geological Services, LLC and Mr. Paul Weibel. With the exception of Mr. Weibel, who serves as the Company’s Chief Executive Officer, none of the qualified persons is affiliated with the Company or any other entity that has an ownership, royalty, or other interest in the property.

The Technical Report will be available on the U.S. Securities and Exchange’s EDGAR website as an Exhibit 96.1 to the Current Report on Form 8-K filed by the Company on August 7, 2025, in connection with this news release. The Technical Report includes relevant information regarding the assumptions, parameters, and methods used for the Mineral Resource and Mineral Reserve estimates for the Fort Cady Project, as well as information regarding data verification, exploration procedures, and other matters relevant to the scientific and technical disclosure contained in this news release.

Other disclosures of a scientific or technical nature included in this news release regarding the Fort Cady Project have been reviewed, verified, and approved by Mr. Paul Weibel, Chief Executive Officer of 5E Advanced Materials, Inc. who is a Qualified Person as defined by Regulation S-K, Subpart 1300 promulgated by the U.S. Securities and Exchange Commission. Mr. Weibel is responsible for reviewing information related to market strategy, product pricing, and economic assumptions.’

The complete Technical Report titled “Preliminary Feasibility Report & Technical Report Summary, 5E Advanced Materials Fort Cady Project” is available on EDGAR as Exhibit 96.1 to the Company’s Current Report on Form 8-K filed on August 7, 2025. It is also available on the Company’s website – HERE.

About 5E Advanced Materials, Inc.

5E Advanced Materials, Inc. (Nasdaq: FEAM) (ASX:5EA) is focused on becoming a vertically integrated global leader and supplier of boron specialty and advanced materials, complemented by lithium co-product production. The Company’s mission is to become a supplier of these critical materials to industries addressing global decarbonization, food and domestic security. Boron and lithium products will target applications in the fields of electric transportation, clean energy infrastructure, such as solar and wind power, fertilizers, and domestic security. The business strategy and objectives are to develop capabilities ranging from upstream extraction and product sales of boric acid, lithium carbonate and potentially other co-products, to downstream boron advanced material processing and development. The business is based on our large domestic boron and lithium resource, which is located in Southern California and designated as Critical Infrastructure by the Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency.

Forward Looking Statements

This press release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements other than statements of historical fact included in this press release should be considered forward looking statements, including without limitation statements regarding the Project’s capital and operating costs; cash costs to produce boron and its related byproducts, as well as estimated contingencies; projected future pricing for boric acid and its related byproducts; the forecasted net present value; projected production volumes and revenues; anticipated cash flows; anticipated cut-off grade and recovery rates; the proposed design of the commercial scale facility; the timing of large-scale commercial production; construction timelines; ability to maintain and modify permits; infrastructure needs; environmental impacts; potential to successfully finance the company and the proposed commercial scale facility; anticipated market value and demand for boric acid, calcium chloride and gypsum; potential technology solutions; anticipated use of land and water; potential for expansion of mineral resources; mineral resource and reserve estimates and assumptions; the potential for future phases of the Project; availability of energy to operate the facility; the economic potential of the Project; and our ability to produce boron and its related byproducts. When used in this press release, the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “budget,” “target,” “aim,” “strategy,” “plan,” “guidance,” “outlook,” “intent,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on the Company’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the extraction of the critical materials we intend to produce and advanced materials production and development. These risks include, but are not limited to: our ultimate ability to satisfy all customer qualification criteria and achieve commercial offtake agreements, our limited operating history in the borates and lithium industries and no revenue from our proposed extraction operations at our properties; our need for substantial additional financing to execute our business plan and our ability to access capital and the financial markets; our status as an exploration stage company dependent on a single project with no known Regulation S-K 1300 mineral reserves and the inherent uncertainty in estimates of mineral resources; our lack of history in mineral production and the significant risks associated with achieving our business strategies, including our downstream processing ambitions; our incurrence of significant net operating losses to date and plans to incur continued losses for the foreseeable future; risks and uncertainties relating to the development of the Fort Cady project, including our ability to timely and successfully complete our proposed Commercial Scale Boron Facility; our ability to obtain, maintain and renew required governmental permits for our development activities, including satisfying all mandated conditions to any such permits; the implementation of and expected benefits from certain reduced spending measures; the impact of changes in U.S. trade policies and the imposition of tariffs; and other risks and uncertainties set forth in our filings with the U.S. Securities and Exchange Commission from time to time. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. No representation or warranty (express or implied) is made as to, and no reliance should be placed on any information, including projections, estimates, targets, and opinions contained herein, and no liability whatsoever is accepted as to any errors, omissions, or misstatements contained herein. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as to the date of this press release.

For additional information regarding these various factors, you should carefully review the risk factors, uncertainties and other disclosures in the Company’s Form 10-K filed on September 9, 2024, as updated by the Company’s Form 10-Q filed on May 15, 2025, and subsequent filings with the U.S. Securities and Exchange Commission throughout the year, as well as in its filings under the Australian Securities Exchange. Any forward-looking statements are given only as of the date hereof. Except as required by law, 5E expressly disclaims any obligation to update or revise any such forward-looking statements. Additionally, 5E undertakes no obligation to comment on third party analyses or statements regarding 5E’s actual or expected financial or operating results or its securities.

For further information contact:

Michael MacMillan or Paola Ashton

PRA Communications

team@pracommunications.com

Ph: +1 (604) 681-1407

SOURCE: 5E Advanced Materials, Inc.

View the original press release on ACCESS Newswire

The post 5E Advanced Materials Publishes Fort Cady Project SK-1300 Pre-Feasibility Technical Report with a US$724.8M Pre-Tax NPV7, 19.2% IRR, Initial 39.5-Year Mine Life appeared first on Local News Hub.